Ajey Kaushal, Senior Investment Associate

Given multiple geopolitical conflicts and major elections in key countries (USA, Taiwan, EU, Russia, India, UK, to name a few), 2024 will remain an unpredictable year for interest rates. However, the cost pressure continues to build for owners of lower-demand assets (i.e. urban office), and we will finally see meaningful asset transactions begin to hit the market ~Q3 onwards.

Sustainability will continue to be a focal point for federal and global governing bodies, and we will see more legislation aimed at both asset owners and corporations to reduce their footprints. As a result, there will be increased adoption of technologies geared to actively reduce and eliminate carbon emissions (not just measure and monitor them).

AI has taken the built world by storm and is creating lasting OpEx efficiencies. However, given the speed of adoption and limited expertise, we will unfortunately see increased reports of meaningful data breaches from our sector, putting the onus on owners to adopt and deploy cybersecurity technology.

Given the volume of capital invested in and limited surface-level differentiation between new AI-powered companies, we will begin to see meaningful consolidation in the space, continuing into 2025.

Arnaud Bouzinac, Growth Principal

Though there are signs allowing cautious optimism as the US Federal Reserve has hinted that interest rate cuts will happen in 2024, in terms of VC investment, we can anticipate a market dynamic that will remain subdued. Investors will remain very selective about where they put their money and startups will have to manage their operations on a very tight budget and keep their cash burn to the minimum. Those not able to do so will continue to suffer or even disappear.

The trend of corporations demanding of their employees to come back to the office more regularly (at least three days a week) will continue although there will be no return to the old 100% in office policy, leaving the future of work challenge still valid, with a big question mark on what to do with all the unused office floors / surfaces and how to make the office “commute worthy”. And there lies an opportunity for tech companies able to address this.

In this context, we still expect startups with rapid ROI to do the best, especially if they can help reduce energy consumption and carbon emissions or generate pockets of efficiency that save hours of manual work or labor. AI will remain a hot topic in 2024 as the real estate big players will race to claim the status of leader in the field, while encouraging the development and adoption of AI-based solutions. A direct consequence from a real estate perspective will be an increased interest in data centers, as their development will accelerate, with an opportunity for tech companies servicing these assets at scale, focusing mainly on smart FM and energy efficiency optimization.

Daniel Correa, Senior Associate

After a year of subdued CRE transaction volumes due to rising interest rates and turbulent market conditions, I foresee a major opportunity for distressed asset sales sometime in 2024. I also expect a new generation of brokers and dealmakers that emerge victorious from this recovery by seriously embracing technology as a competitive advantage.

There will be a heightened focus on sustainability in the Commercial Real Estate (CRE) market. More buildings will begin to adhere to green building standards (like Local Law 97 in NYC) by incorporating renewable energy technologies or undergoing sustainable retrofits. This will be driven by regulatory mandates and increased tenant demand for sustainable spaces.

Growth of ecommerce will continue to propel demand for warehouses and distribution centers. The explosion of online ordering and consumer expectations for fast delivery will push companies to establish a physical presence in multiple locations, increasing demand for industrial real estate. Geo-political tensions have also highlighted the vulnerabilities of our global supply chains, which will advance the growth of scalable alternatives such as nearshoring and domestic manufacturing. This will result in a major opportunity for emerging markets like LATAM and the rural US.

Although commercial office occupancy rates will continue to struggle, demand for best-in-class space in major markets will remain strong. This flight to quality will be indicative of the kinds of assets, services, technology, and amenities that top tier tenants are looking for. This will begin to carve out leaders in each space and further define the difference between a nice to have and must have.

Technological integration in the property sector will likely increase. This means more functional use of AI, IoT, machine learning, digital twins, and Blockchain – not just for transactions, but for managing infrastructure, security, and real time data management. System standardization around smart building management where facilities and systems are interconnected will become more prevalent.

Danny Klein, Vice President of Innovation

The commercial real estate industry faced challenges last year due to high inflation and interest rates, resulting in lower transaction volume and limited investments in new technologies. However, towards the end of 2023, inflation started to decrease, along with mortgage rates, and a looser stance from the Federal Reserve. These positive developments position the CRE industry favorably for 2024.

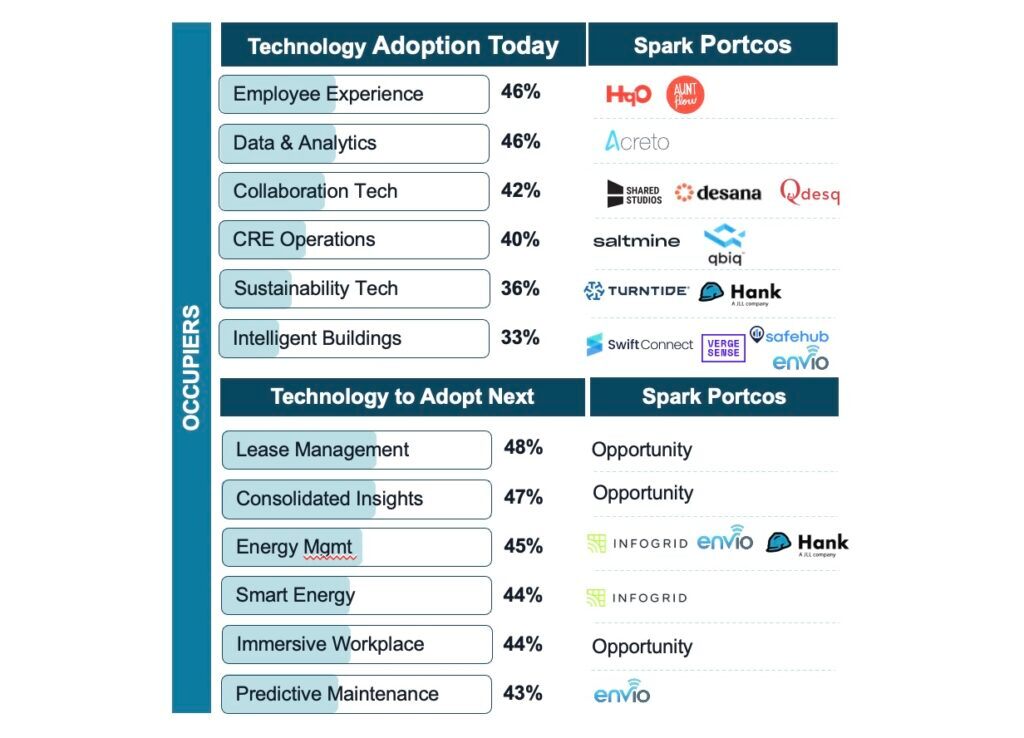

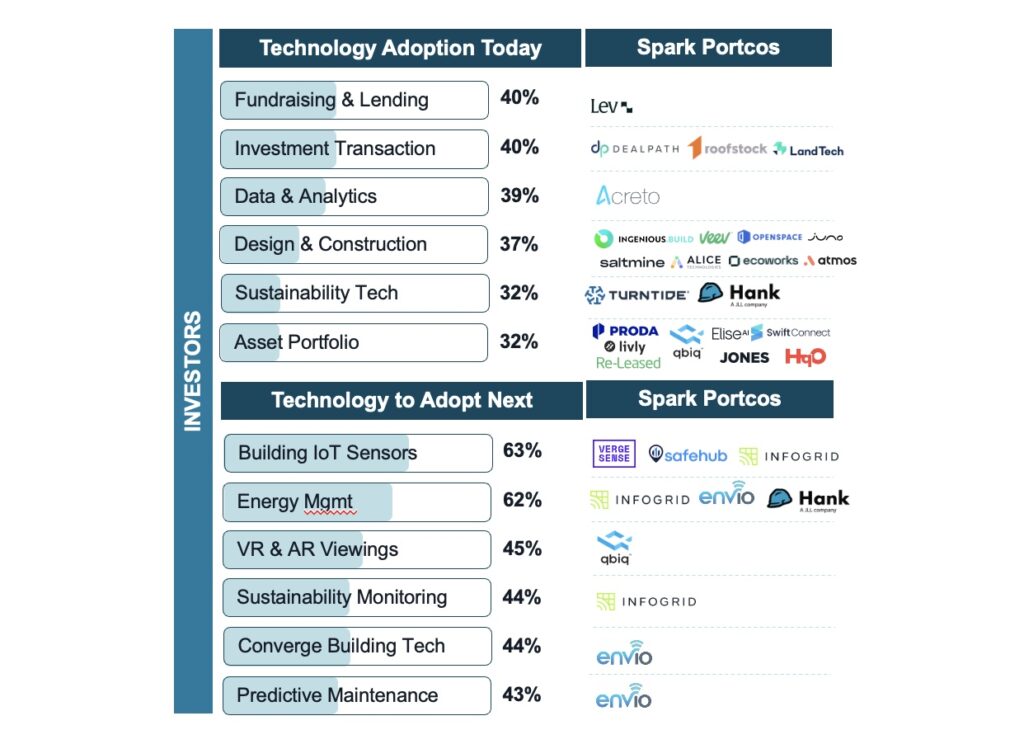

In 2024, there will be renewed interest from occupiers and investors to implement sustainability technologies to meet broader corporate objectives. Additionally, investors are likely to increase spending on smart building technologies to differentiate their assets with occupiers and improve occupancy rates.

While there may still be some challenges ahead, we will begin to see an improved landscape for the CRE industry.

Laurent Grill, Partner

When considering the incorporation of artificial intelligence (AI) across various real estate sectors over the next phase, several areas stand out where the impact of AI is expected to be significant in 2024:

- • Property management: AI can automate and optimize property management processes, such as tenant screening, lease management, and maintenance scheduling. Machine learning algorithms can help predict rental demand and optimize pricing strategies, improving revenue potential for property owners.

- • Asset management: AI-powered tools can analyze large datasets and provide real-time insights on asset performance, risk assessment, and portfolio optimization. This enables proactive decision-making, such as identifying underperforming assets and implementing strategies to enhance returns.

- • Smart buildings: AI can enhance the operational efficiency and sustainability of buildings by monitoring energy usage, optimizing HVAC systems, and automating maintenance schedules. AI-enabled smart building systems can self-adjust based on occupancy patterns, reducing energy consumption and improving tenant comfort.

- • Real estate investment analysis: AI algorithms can process extensive market data, including historical patterns, demographics, and economic indicators, to provide investors with accurate valuation models and risk assessments. This helps investors make informed decisions and optimize their investment strategies.

- • Real estate marketplaces: AI algorithms can personalize property search experiences, recommending properties that match a buyer’s preferences, budget, and location. AI can also enable automated valuation models, reducing the time and effort required for property valuations and transactions.

Raj Singh, Managing Partner

Macroeconomic conditions will not significantly improve until the end of Q3 2024 which means conditions will remain challenging for PropTech startups. Deal volume, dollars invested, and exits will likely be similar to 2023 levels, possibly saved by an uptick in Q4.

Despite (or perhaps because of) the climate, seed stage startups will still emerge, focused on delivering quantifiable RoI around asset management, energy and sustainability, financial derivatives applied to construction to smooth out supply and demand imbalances and enabling the industry to deliver against increasingly tight regulation.

Startups enabling RE companies to maximize the use of technology through education and services will build initial market traction as the industry attempts to benefit from generative AI solutions that bring significant efficiencies (although not yet new business models) and change the competitive landscape.

Improving conditions towards the end of the year will have a number of the larger startups prepping for exits but likely M&A rather than IPO as few of them will be able to produce revenues above $100MM.

Sean Wright, Investment Principal

Commercial real estate prices will continue falling in 2024 but will bottom out mid-year when central banks begin lowering interest rates.

Sustainability will continue as the dominant PropTech theme and will garner the lion’s share of PropTech VC investment in 2024. Similarly, sustainable building upgrades will drive real estate investment.

By the end of 2024, AI will be commonplace in PropTech, and no longer a point of differentiation. For most prime office and residential space, AI will be working in the background to improve our experience and improve efficiency.

Sonia El-Sherif, Chief of Staff

In light of the upcoming elections and global geopolitical shifts, there’s an escalating demand for PropTech cybersecurity startups. These startups will be crucial in protecting real estate data, reinforcing smart building systems, including access controls and IoT devices, and aligning with cybersecurity regulations.

The Middle East, especially Saudi Arabia and the UAE, is expected to experience significant growth in ConTech and PropTech, bolstered by major giga-projects, AI innovations and sustainability efforts. Additionally, India’s rapid development in broker tech, ConTech, AI, and IoT suggests a robust pipeline of groundbreaking PropTech innovations in 2024, contributing to global advancements.

With the surge in AI-related demands and prolonged timelines for data center development, the industry is facing a shift towards alternative energy sources. I foresee an increase in startups specializing in renewable energy solutions, supply chain optimizations, and technologies to support evolving data center infrastructures, particularly in cooling systems to manage the high-power usage of AI components. These startups will be vital in ensuring the environmental sustainability and operational efficiency of data centers, catering to the growing energy needs of the sector.

Interested in a strategic partnership with JLL Spark? Apply for an investment here.